Perks and pitfalls of housing your workers

Businesses need to navigate a minefield of tax, tenancy and employment law to offer workforce accommodation to their staff.

Each field is separate but interlinked and it’s best to get some dedicated, specialist advice from the professionals, both before taking the plunge and throughout the process.

But, as a primer, Jason Smith, of Five Peaks Chartered Accounting, and Sylvie Thrush Marsh, of MyHR, gave Queenstown Business Chamber of Commerce members some broad brushstrokes of advice, at the second Staff Housing Information Series recently.

Smith says businesses who own a property and choose to house their workers in it have an advantage over other landlords, as the mortgage interest is tax-deductible, thanks to an exemption from the new rules governing rental properties.

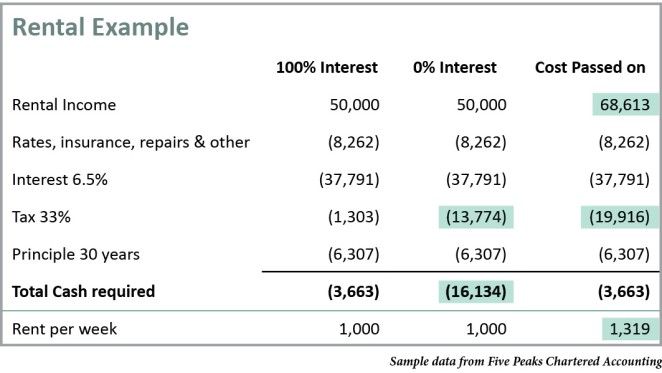

On a $960k four-bedroom Fernhill property, for example, a business housing its workforce could charge them $1000-per-week rent and only need to stump up $3663 extra to pay the mortgage each year (see table), as 100% of the interest would be deductible.

A landlord unable to deduct the interest, in contrast, would either need to put in $16,134 per year or increase the weekly rent to $1,319, to offset the cost - a 30% increase in rent.

“Interest deductibility has a big impact on the landlord’s costs,” Smith says.

“As long as the ownership of the business and the rental is the same, you can claim 100% of the interest. Employers, therefore, have a slight advantage over other property investors.”

Another option for businesses is to consider shared ownership or offering employees accommodation supplements, although that would be taxed through their wages.

Stats showed the rental stock had already decreased by 30% in the past year, as the interest deductibility rules began to bite, making it even harder for workers to find somewhere to live.

“If that carries on the position becomes a lot worse, especially if the rents go up 30% as well.”

Airbnb owners are subject to the same rules as private landlords, i.e. they won’t be able to deduct their mortgage interest, whereas commercial accommodation, such as hotels and motels, operate under different rules.

Sylvie Thrush Marsh says those businesses that choose to become landlords need to have their paperwork sorted, including an employment agreement, tenancy agreement, bond, etc.

And they need to recognise they have two relationships with one person.

“As an employer, you are governed by legislation, like the Employment Relations Act, the Health and Safety at Work Act, and all the guidelines and parameters that protect them as employees don’t magically disappear because they are now also a tenant.

“And you also have a relationship with them as a landlord. So, the Residential Tenancies Act, the Healthy Homes Guarantee Act, the requirements around the types of facilities your accommodation has, the terms and conditions of a tenancy relationship, all those apply.

“You must meet your obligations in both of those different jurisdictions.”

Any issues with the person as an employee, or issues with them as a tenant, must be dealt with separately.

And there are added nuances to the relationships too.

An employer cannot exert undue influence to make a potential employee agree to live in the businesses’ accommodation, although that’s not likely to be a problem in Queenstown. Any business deducting rent from the employee’s pay packet also needs to put the amount in the employee contract, otherwise, they can only legally deduct 5% of wages.

Neither can they just kick them out. They can only give notice on the tenancy if the employment is also ending, although there are other ways to exit the tenancy relationship and this does not apply if the accommodation is not their permanent address (an oil rig, for example).

There are scores of different scenarios to deal with, such as housing couples where one is an employee and one isn’t, how to provide short-term accommodation to help workers get established in town, not to mention what happens if a house full of employee flatmates have a major falling out. So, there’s a lot to consider and having professional help, or an arm’s-length property manager, is always advisable.