Bursts then bumps for local building industry

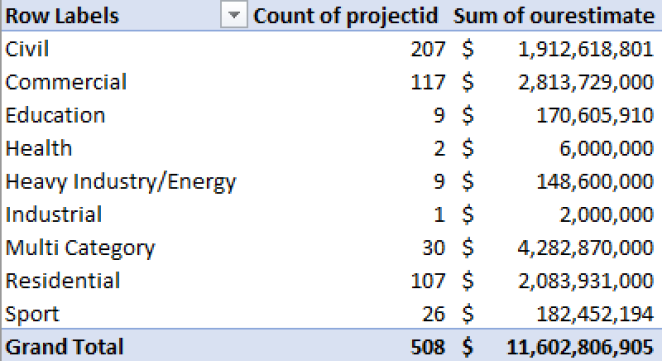

There’s a whopping $12 billion in the construction pipeline for Queenstown Lakes, according to the latest figures from Pacifecon. That comprises 508 projects across all sectors, with residential builds making up 21% of that number, and 18% of the value.

Pacifecon are a New Zealand business that have been reporting on our construction industry for over 40 years. While overall, we’re seeing costs stabilising across the industry, researcher Carolyn Rennie says that Central Otago can be slightly different to the rest of the country as there’s more diversity in the location of developers working here.

“Wānaka and Queenstown at the moment are both strong in standalone houses and apartments – at building and resource consent level – at that new stage,” Rennie says. “The work at the moment seems to come in bursts, and then it dies off again, so it’s unpredictable. There is a sense that when these bursts of work comes in, it’s old projects, rather than new construction projects – maybe they’ve had it on the back burner for quite some time.”

In the past 12 months, 899 projects commenced construction at a value of $2 billion. Residential made up $1,184,512,914 of this number. Singling out Wānaka – there’s currently 188 projects to the value of $2,461 million in the pipeline, with no apartments on the cards.

Philip Dawes is the research manager at Pacifecon. He’s responsible for managing and leading the nationwide research and edit team to ensure all information put out is accurate and of high quality. He’s across what’s happening in the residential sector across the country and oversees each report with a keen interest in the Market Watch.

“By the end of August, New Zealand had 6,566 residential projects in early planning stages, which represents the intention of residential activity, valued at $103 billion,” Dawes says. “As expected, the number of these intended projects has slightly decreased when compared to 2023 due to caution in the residential sector, however, these figures remain higher than those before 2021 and beyond.”

Some trends we’re seeing in the residential sector specifically includes an increase in the number of town houses and apartments popping up around the country. Of the 107 residential projects in our local pipeline, it is interesting to note that 18 are apartment buildings at a value of $515 million – something not as common for our region, but growing in popularity.

Some projects to highlight in the region include two large healthcare projects in Wānaka – the Wānaka Health Hub and the ROA Healthcare Precinct. There’s also the Mount Iron Junction mixed-use development that has been selected for fast-track resource consent, and resource consent has been granted for MetLife Wānaka Retirement Village. Nine projects in Queenstown have been selected for the Government’s new fast-track development pathway including Silver Creek, a 1050-lot subdivision above Frankton Road and The Hills Resort Development, an 18-hole championship golf course and resort. Civil works have commenced on a number of subdivisions.

“Work is starting to flow better,” Rennie says. “There seems to be a sense of not wanting to be mired in a council queue for consenting, to not slow down expedition of a possible shovel ready project. In terms of build costs, some things are slightly less expensive, but the biggest thing that impacts pricing is if the bigger builders are busy or not. The flow-on effect of this means a project will be tendered, which provides competitive pricing.”

Taking a look at Cromwell, things appear to be pretty steady over that way. The Wooing Tree mixed-use development will see 380 houses being built, with a commercial element to it, too. Rennie is also seeing a steady stream of building consents flowing through for the standalone houses – they’re now up to stage three of the project.

“The cellar door has been completed, and the childcare centre completion is expected in 2025, so now that seems to be popping along. In terms of building consents in the Central Otago area as a whole, I would say there’s slightly fewer than previous years, but there’s still a lot in terms of stand-alone housing and apartments.”

It seems to be the consensus that the ‘bump’ in our construction industry is in part thanks to developers that are based overseas. Where a local developer can make quick and informed decisions, a developer in Australia or Singapore may have a very different decision-making process – perhaps they adopt a world-economy view rather than a local-economic one.

The fast-track scheme could help to push along some of the bursts of work, and allow a more steady pipeline for Queenstown. More residential housing that isn’t snapped up by holiday-home investors would certainly be welcome.

If you’d like to read more of Pacifecon’s reporting on the industry as a whole, you can head to pacifecon.co.nz